THE AUTHOR

Christian Twiste

Chief Digital Officer

Likewise, Microsoft Dynamics 365 CE proves to be an invaluable asset in the insurance landscape. Employing cutting-edge customer relationship management solutions, insurers can pivot their focus towards customers, reaping substantial rewards. Elevate your customer retention rates, proactively manage risk, slash operational expenditures, and unleash the potential of customer data monetization with Microsoft Dynamics CRM Implementation partners.

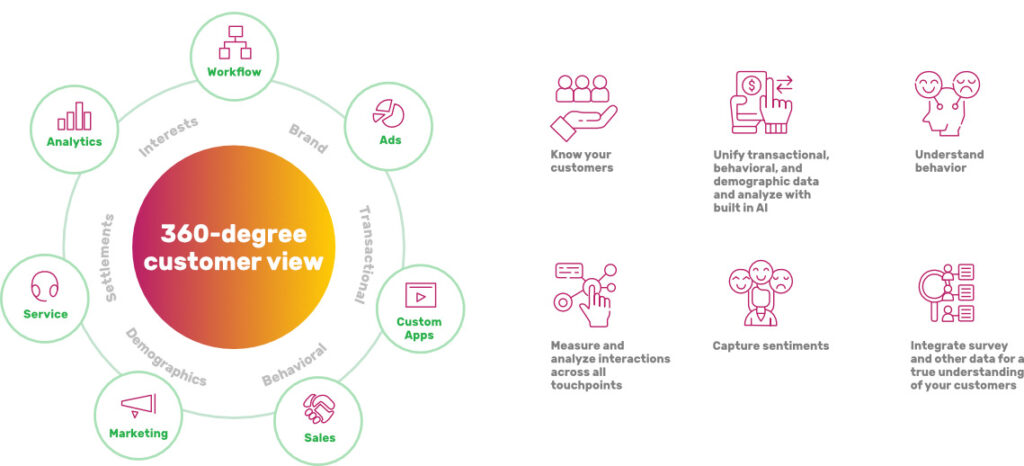

By arming agents, brokers, sales teams, and service representatives with a comprehensive 360-degree view of customer information, coupled with real-time analytics and automated workflows, Microsoft Dynamics 365 CE empowers insurers to maximize the profitability of each customer. This translates into tailor-made offers and personalized services that not only enhance satisfaction but also foster trust.

Dynamics CRM for Banking

Unlock the Full Potential of Banking with a Microsoft Dynamics CRM Partner.

360-degree Customer View and Workflow Automation

- Automating Workflows: Say goodbye to manual tasks! Microsoft Dynamics 365 CE streamlines processes like customer onboarding, loan processing, and account opening, making them simpler and faster.

- 360-Degree Customer View: Imagine having a complete view of each customer across all channels. Microsoft Dynamics 365 CE provides this by centralizing customer data, ensuring teams have the most up-to-date information at their fingertips.

Microsoft’s Fully-Featured Customer Data Platform

- Real-Time Insights: With Customer Insights, real-time analytics help banks identify areas for improvement and adjust strategies on the fly, elevating customer satisfaction levels.

The Microsoft Dynamics 365 CRM system empowers banks to tap into valuable consumer insights, drive strategic decisions, and deliver personalized experiences that set new industry standards.

Revolutionize your banking experience with Microsoft Dynamics CRM Implementation.

Tailored Sales and Service Platform and Marketing

In banking, adaptability is key. Microsoft Dynamics 365 CE equips banks with the tools to thrive amidst shifting customer expectations and evolving technology.

- Targeted Marketing: Build tailored campaigns that resonate with specific customer demographics and behaviors, driving engagement and boosting revenue.

- Enhanced Collaboration: Foster teamwork and informed decision-making through real-time data sharing, enhancing your customer experience strategy.

- Client Satisfaction: With Microsoft Dynamics 365 CE, deliver personalized services that meet each customer's unique needs, based on real-time data and insights into their behavior.

- Efficient Operations: Dynamics 365 consultants seamlessly coordinate departments to handle customer inquiries swiftly and accurately. Automate tasks like data entry and lead management, freeing up employees to provide top-notch service while reducing errors and saving time.

Implementation of Microsoft Dynamics 365 CE empowers banks to build lasting customer relationships, driving investments and cultivating long-term loyalty in a fiercely competitive industry.

Tailored D365 Customer Experience

In the banking and financial sector, delivering personalized service is key. Microsoft Dynamics 365 CE makes it happen, giving your bank a complete view of each customer’s financial history, accounts, and transactions. This data empowers you to tailor your services to meet individual needs and goals, ensuring a top-notch customer experience.

More D365 Customer Engagement

Microsoft Dynamics empowers your business to boost D365 customer engagement through multichannel communication. They can send personalized messages via email, SMS, and social media, while also offering a user-friendly portal for easy access to accounts and transactions. This enhances customer satisfaction and loyalty.

Enhanced Productivity

Microsoft Dynamics 365 CE transforms your banking operations, liberating time and resources for crucial tasks. It handles data input, document management, and workflow coordination, allowing you to focus on mission-critical activities. With real-time data insights, it empowers quick, informed decisions, seamlessly integrating with Microsoft tools for efficient bank orchestration.

Security and Compliance

Microsoft Dynamics 365 CE is custom-made to reinforce your banking sector’s security and compliance requirements. With its array of tools, including role-based access control, data encryption, and comprehensive audit trails, it stands as the ultimate Dynamics CRM solution for keeping regulatory obligations in check. It helps your bank to effortlessly manage diverse regulatory tasks, spanning from Know Your Customer (KYC) and Anti-Money Laundering (AML) to the intricate realm of fraud detection.

Microsoft Dynamics 365 CE for Insurance

Enhance Engagement with Personalized Customer Experiences

Enhance loyalty by tracking client demographics and interaction history, creating and nurturing campaigns, pinpointing ideal products and services, and delivering personalized service via comprehensive customer management capabilities.

Watch Agent Performance

Keep tabs on individual agent performance, equip them with effective sales tools and personalized training, and take proactive steps to enhance their performance and loyalty.

Develop Long-term Relationships

Cultivate enduring connections by effectively overseeing broker and customer relationships, fostering loyalty through transparent interactions, and tailored services that build trust.

Boost Sales

Streamline processes to swiftly generate new quotes with Dynamics 365 consultants, optimize cross-selling and up-selling chances, and encourage policy renewals using robust deal tracking, workflow management, and insights into customer preferences and purchasing patterns.

Optimize Service

Equip agents and service staff with contextual analytics, intuitive case tracking, and collaboration tools to provide top-notch service across all channels. Simplify claims handling, escalations, and processing through efficient workflows.

Benefit from the Cloud

Leverage Microsoft’s substantial investment in cloud technology, robust security infrastructure, and a 99.9 percent uptime service level agreement (SLA) through the Microsoft Dynamics CRM Implementation Online.

Centralized Policy Holder Data

Offer staff and agents role-specific access to customer history, preferences, key relationships, profitability insights, and support records, enhancing client trust and boosting productivity.

Workflow Automation

Minimize tedious tasks, automate paper-based processes, and simplify policy applications, approvals, and issue resolution through robust workflows. Enhance efficiency in underwriting, policy issuing, and claims processing with guided dialogs as well as alerts.

Actionable Analytics

Empower sellers and brokers with insightful analytics and KPIs on policies, client interactions, and claims to drive informed decisions. Stay ahead with real-time dashboards offering insights into clients, brokers, risk exposure, and sales performance across regions, branches, and agents.

Enhanced Sales

Equip agents with customer-based alerts and tailored suggestions to optimize cross-selling, offer customization, and policy renewal management. Foster collaborative team selling with unified customer data and collaborative tools.

Why Korcomptenz?

Conclusion

Microsoft Dynamics 365 CE is the game-changer for the banking and insurance industries. It revolutionizes customer experience, streamlines operations, and enhances security and compliance. With Microsoft Dynamics 365 CE, you can empower your teams, personalize customer experiences, and boost sales and productivity. It’s the key to building lasting relationships, staying competitive, and thriving in the ever-evolving landscape of finance. Please request a free consultation to learn more.