Financial Fraud Prevention with Cloud- AI: Redefining Banking Security

#DrivingExpertLedTransformation

THE AUTHOR

Nishanth Gotte

Lead Consultant - Cloud

Table of Content

- Introduction

- The New Landscape of Bank Fraud

- Why Cloud-Based AI Is the Future of Fraud Prevention?

- The Three Pillars of AI-Powered Fraud Detection

- Smarter Banking with Cloud Fraud Detection

- Building a Future-Ready Bank: Steps to Cloud Success

- Building Trust Through Enhanced Fraud Protection in Banks

- Why Korcomptenz for Cloud Security and Resilience

- Final Thoughts: Leading the Charge Against Financial Fraud

Introduction

Banks, payment companies, and fintechs are riding a wave of digital adoption as consumers increasingly adopt digital wallets, online investments, and peer-to-peer lending. According to McKinsey’s 2024 report, approximately 90% of consumers in the US and Europe now use digital payments, a convenience that also increases the risk of fraud.

Juniper Research also predicts that payment fraud will reach over $362 billion by 2028, with approximately half of the total related to the remote purchase of tangible items.

As digital banking becomes the new norm, financial fraud prevention is no longer optional; it’s now a boardroom imperative. While fraudsters are employing sophisticated methods that leave old-fashioned methods in the dust, embracing cloud-based fraud detection software for banks enabled by AI and ML is imperative. Not only does this bolster security, but it also fortifies customer trust through secure, frictionless banking experiences.

In this blog, we explore how cloud-based AI workflows are transforming fraud protection in banks, the core pillars of AI-powered fraud detection, and practical steps for successful cloud migration.

The New Landscape of Bank Fraud

- Identity theft and synthetic identity fraud.

- Account takeover fraud.

- Payment fraud (credit or debit card fraud, wire transfers).

- Insider fraud.

- Online fraud, including phishing and social engineering.

Based on the ACI Worldwide report, global bank fraud losses are expected to surpass $40 billion by 2027. This steep increase underscores the need for financial institutions to improve their bank fraud detection and prevention methods beyond mere rule-based approaches.

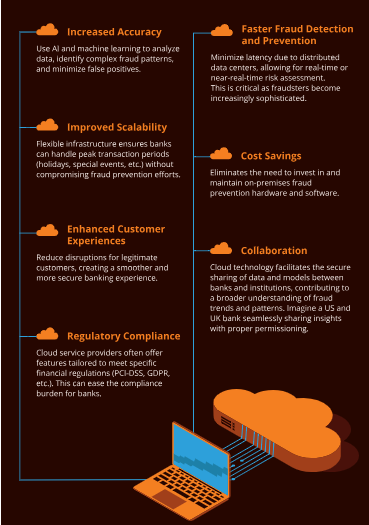

Why Cloud-Based AI Is the Future of Fraud Prevention?

Rather than relying on rigid rules and static historical data, modern banks are partnering with fintech innovators to deploy AI workflows that analyze massive volumes of transactional and behavioral signals in near real-time. This dynamic approach strengthens fraud detection across three critical areas:

Identity Verification

Identity Authentication

Fraud Prevention

The Three Pillars of AI-Powered Fraud Detection

AI-powered fraud protection in banks is transforming cybersecurity strategies through these critical advancements:

Real-Time Data Processing

Continuous Model Optimization

Real-Time Decisioning

Smarter Banking with Cloud Fraud Detection

Building a Future-Ready Bank: Steps to Cloud Success

- Prioritize Cloud Transformation: Focus on early cloud migration on digital channels where the majority of online transactions occur and fraud risk is greatest. Prioritization targets the greatest immediate vulnerabilities and sets the stage for more extensive cloud adoption.

- MVP and Business Case Focus: Create a Minimum Viable Product (MVP) that illustrates quantifiable enhancements in fraud prevention and detection. This allows for investment rationale to be supported through visible business benefits early, especially in electronic banking channels.

- Phased Migration: Avoid wholesale, high-risk overhauls. Instead, migrate capabilities in phases, beginning with areas where the bank has previously invested in fraud prevention. This ensures continuity and reduces the effects of operational disruptions.

- Avoid Duplicate Legacy: Inefficiencies: Evaluate current systems carefully to avoid moving obsolete processes or bottlenecks to the cloud. Cloud migration offers the chance to update processes and refine fraud detection.

- Pick the Appropriate Technology Partners: Pick cloud providers and fintech partners based not only on their platform abilities but also on their implementation and support expertise. The proper partner will walk the bank through a seamless transition and assist in leveraging maximum advantage out of cloud-based anti-fraud solutions.

Building Trust Through Enhanced Fraud Protection in Banks

- Act more quickly to detect and prevent fraud.

- Minimize unwarranted security alerts that frustrate customers.

- Meet increasingly demanding regulatory compliance norms.

- Provide frictionless digital experiences without sacrificing security.

Why Korcomptenz for Cloud Security and Resilience

In the current threat environment, successful fraud prevention strategies in banks require more than traditional tools. We assist in future-proofing your defenses by deploying AI-based online fraud prevention solutions, automation, and leading-edge threat detection, ensuring your cloud infrastructure actively supports both operational integrity and customer trust.

Final Thoughts: Leading the Charge Against Financial Fraud

- Using fraud detection software for banks running in real-time with AI and ML.

- Cloud migration prioritization through a clear, phased strategy.

- Collaborating with fintech pioneers and cloud providers to drive ongoing innovation.

- Customer-focused security that has the right amount of protection and convenience.

If you’re ready to explore how cloud-based AI workflows can transform your bank’s fraud prevention capabilities, let’s start a conversation today!

Focus on you

Share this article

Use AI to summarize this article