Invest in Your Future with an ROI-Focused Mindset for Your Bank

In an era of digital transformation, banks that focus on obtaining measurable value outperform the rest. Discover how our ROI-first strategy accelerates modernization, customer experience, and sustainable growth

Our Business Value Register:

ROI You Can Audit

Bank-tested discipline for measurable impact. Our Business Value Register defines value hypotheses, secures baselines, sets targets, assigns owners, and tracks realized benefits. Automated ROI, leakage detection, and FinOps/ITSM-aligned dashboards convert initiatives into verified financial outcomes.

Bill Schlageter, former CIO and VP of Enterprise IT Transformation, has led a $5 billion company. With 25+ years of experience leading technology and digital transformation across 40 sites in 25 countries, Bill brings deep, hands-on transformation expertise. Hear him speak about the BVR in an exclusive C-suite roundtable session.

20%

Faster Time-to-Market

20%+

Fraud Detection Improvement

99%

Compliance Efficiency

99%

System Uptime

Lock in your ROI before you invest

Schedule a Business Value Register demo—quantify savings fast.

Outcomes

Why Partner with us on KOR ROI-Driven Banking Suite

Measurable ROI on Every Initiative

Phased Modernization, Zero Disruption

Security and Compliance by Design

Trusted Data that Drives Better Decisions

Seamless Omnichannel Experiences

Future-Ready Technology Foundation

Core Banking Transformation

Digital Banking Enablement

Data & AI:

Fraud & Security:

Open Banking Integration:

Application Development:

Intelligent Automation:

Legacy Modernization & Managed Services:

CRM for BFS:

Measurable ROI on Every Initiative

Every transformation starts with data-backed business modeling. We quantify impact upfront and validate it post-implementation — ensuring every dollar spent ties to tangible savings or revenue growth.

Future-Ready Banking

Faster product launches, lower operating costs, improved reliability, real-time data, compliance readiness, and scale.

Customer experience – Automation/Agentic AI - Digital Banking Enablement

rapid feature delivery across mobile/web; personalized banking experiences driven by AI

Frictionless Customer Journeys

Faster growth with lower cost-to-serve: higher acquisition and activation, 24/7 self-service, fewer calls, quicker resolution, personalized cross-sell, reduced churn, improved NPS, and audit-ready, compliant journeys.

ROI - BVR

Discover your ROI before you invest.

Schedule a complimentary Business Value Discovery Workshop and see how much your transformation could save.

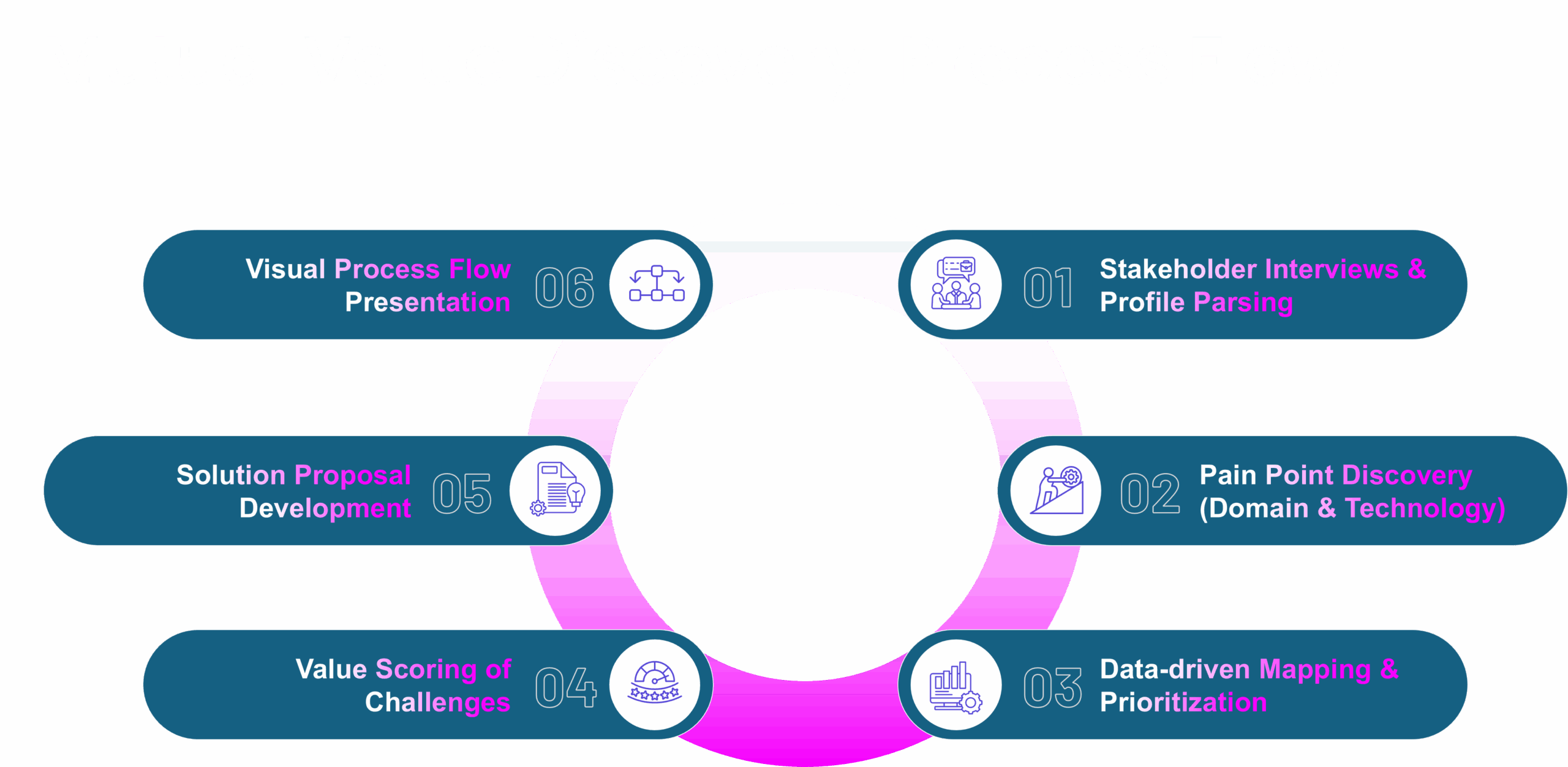

How to Get Started

Designed to De-Risk Transformations for your bank

A fool proof framework that help you to deliver measurable ROIs even before you start on your IT and CX transformation journey.

Try Before You Commit!

- Mutual Value Discovery

- What you get

- Proven results

- Who should attend

- Outcome in a day

A One-Day Mutual Value Discovery (MVD) Workshop

One day to clarity. Leave with a prioritized, compliance-aware roadmap and clear value metrics.

Focused. Measurable. Expert-led.

Identify gaps, prioritize high-impact initiatives, and quantify business value with expert guidance. Experience our AI-driven banking solutions live.

Built for visionaries shaping the future of finance.

Ideal for C-suite leadership that drive transformation acrossrisk, data, and operations with AI-powered modernization and business reinvention.

Your future banking blueprint — defined.

Walk away with a ready-to-execute plan spanning digital core transformation, risk analytics, fraud detection, Customer 360, personalized CX, and regulatory-ready data platforms.

KOR ROI-Driven Banking Suite

KOR Full-Service Banking Suite

Transform your bank with modernization, cloud, infrastructure, cybersecurity, and standout CX—ROI-centric, regulator-ready, and scalable—so every initiative moves from promise to measurable performance.

Cloud modernization

Cybersecurity

Data Modernization

Strategic AI Journey

Managed services

Organizational Change Management

Artificial Intelligence

Deliver smart, secure and engaging AI-powered experiences

Unify data, unlock intelligence, and deliver delightful experiences—safely, compliantly, and at enterprise scale.

Hyper-personalized product recommendations

24/7 conversational AI

Advanced Transaction Monitoring

Holistic Entity Resolution

Dynamic Customer Risk Profiling

Technology

Our Proven Transformation Approach

Assess & Strategize

Architect & Modernize

Automate & Secure

Manage & Optimize

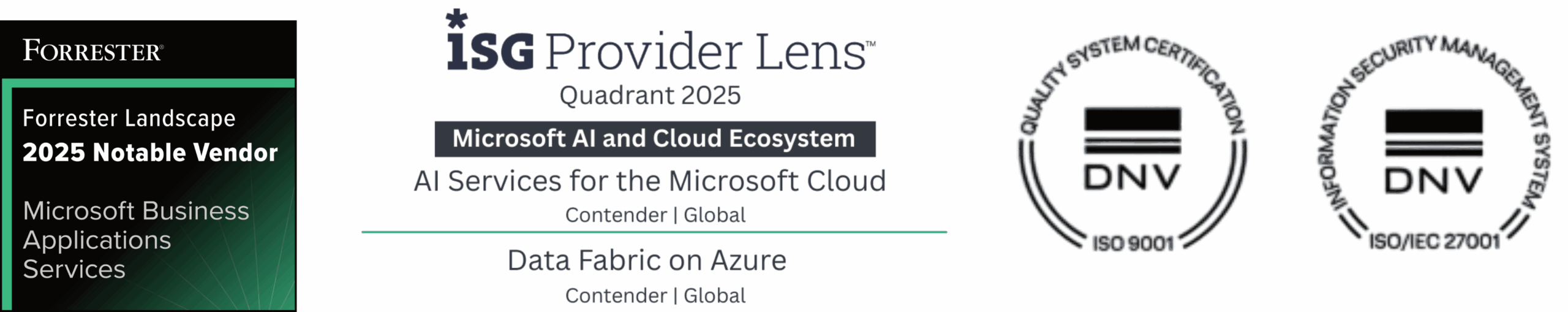

Our Certifications and Accreditations

Contact

The next-gen digital banking solution for all your needs

Please enter your information

Explore More BFSI Accelerators